missing out on the 51% opportunity.

If you're a healthcare investor not actively investing in solutions serving 51% of the population, you're likely not a very good investor.

Undervalued businesses. Resisilant founders. Massive market opportunity.

What more could you ask for to make money as an investor?

The facts & figures.

Working definitions (for the sake of argument)

- Women’s health: conditions unique to women + those which may affect women differently.

- Women: referring to those with XX chromosomes and reproductive organs.

Women make up 50.8% of the US population and drive 80% of healthcare spending. However, women's health has been historically underfunded and underserved. This represents a major market opportunity for companies focused on women's health issues.

According to McKinsey, women's health is a $500 billion market in the US alone. However, only 4% of healthcare R&D funding goes towards conditions that primarily impact women. As the population ages, chronic conditions like diabetes, heart disease, and obesity are affecting women at higher rates.

Underlying all healthcare conditions and treatments in the US are ethnic and racial disparities for minority groups. For the sake of this overview, I am highlighting some opportunities in which specific minority groups of women often face larger healthcare gaps. This is not an exhaustive list.

Women's health represents an attractive long-term investment opportunity for several reasons:

- Women drive a disproportionate amount of healthcare spending (85%).

- Historic underfunding of women's health R&D has led to many unmet needs and 'low-hanging fruit' opportunities.

- Aging population and rise in chronic conditions significantly and disproportionately impact women.

- Minority groups face the largest gaps in women's healthcare, with the highest spending for long-term care and higher mortality rates.

- High growth potential.

With the right technologies, services, and treatments targeted at women, companies in this space can capture a significant piece of this $2T market opportunity.

An investment in women's health companies allows exposure to a high-potential part of the healthcare sector that is poised to expand rapidly in the coming decades. Many of the solutions that are in high demand aren't innovative or new; they are more about executing what we know works.

For example, improving maternal health outcomes (where we're currently ranked below any other developed country) can be driven by removing the burden from only OBGYNs to be distributed across midwives, Doulas, and non-clinical support.

Incentives in the US healthcare system are misaligned with improved health outcomes, but they are well aligned when death is involved. In women's health, we have both. And we're seeing an increase in appetite from health systems, government programs like Medicaid, and the general population demanding better from us.

Demographics are favorable.

There are 320M people in the US, and ~166M of them are women and represent ~51% of the total population.

The US female population is growing, especially in older age segments. The 65+ female population is projected to double between 2015 and 2050, as women tend to live longer than men for a variety of factors such as lifestyle and biological impacts.

More than three-quarters of those 65 years and older say they go online for health information, and 9 out of 10 women report seeking health information online more than their physicians. And ~66% of all women feel misunderstood by the healthcare market and account for 93% of OTC pharmaceutical purchases.

As our aging population becomes a tech-savvy segment for the first time ever, and with the widespread adoption of smart devices, we'll be able to capture insights we've never had before.

As women age, healthcare needs and spending increase significantly, especially regarding conditions they experience, such as Menopause, which is mostly treated with cash-pay solutions.

Chronic conditions are on the rise.

Obesity, diabetes, heart disease, osteoporosis and other chronic issues are impacting women at higher rates. Sex-disaggregated CMS data for the twenty-one CMS-defined chronic conditions demonstrate six conditions that occur more frequently in women: hypertension, arthritis, depression, dementia, asthma, and osteoporosis.

Few sex-specific guidelines for the clinical treatment of chronic conditions exist, so we don't even know what we don't know yet when it comes to treatment and what works. For example, during a heart attack, women may experience back pain, dizziness, or nausea, while men are more often present with chest pain and diaphoresis.

Resulting in missed diagnoses and worse health outcomes. Such as the 11.8% of women who die after a heart attack compared to 4.6% of men within 30 days. Minority women are disproportionately affected.

Chronic conditions require lifelong treatment and care and often default to a trial-and-error approach to treatment vs. a data-informed approach.

It's a built-in recurring subscription model with a clear ROI across healthcare stakeholders.

Insurance saves money by getting a faster diagnosis and less complicated treatment and hospital stays,

Hospitals are ranked higher with lower mortality rates and better outcomes. (But make less money)

People are healthier and live. (This should be the highest priority, but that's not how our healthcare system is incentivized).

Fertility and reproductive health are growing markets.

Puberty is starting earlier for women. In the US, the average age of menarche, or a girl’s first period, is now 12, down from 14 a century ago and as much as six months earlier than 20- 30 years ago. Historically, women have had their periods for ~40 years of their lives. What are the long-term impacts of getting it earlier? What do 50 years of periods look like? What's the environmental impact of that much more menstrual waste?

Infertility affects at least 10-15% of women. The US fertility treatment market alone is ~$10 billion for IVF, storage, and treatment and is growing about 12% annually through 2025. IVF alone is $5B and growing over 5% annually. And is mostly paid out of pocket with costs upwards of $10,000, depending on the service — unless you work for a great tech company with coverage.

Contraception also represents increasing needs, as side effects and bad user experience are driving a rise in non-use and natural alternatives like cycle tracking. More options are better, but when insurance refuses to pay for it despite ACA mandates, we limit individual decisions and agency over one's body.

STD/STI’s

There are roughly 20 million new cases of sexually transmitted infections (referred to as STIs or STDs) annually in the US, according to the CDC. The most common sexually transmitted infections in the United States are HPV, chlamydia, and gonorrhea. These conditions effect both men and women, however the burden of responsibility for testing and treatment often falls to women.

New cases of chlamydia were 16% higher in 2019 than in 2015. New cases of gonorrhea were 53% higher, and new cases of syphilis were 71% higher in 2019 than in 2015.

About 30% of all cases of chlamydia, gonorrhea, and primary and secondary syphilis were in non-Hispanic Black people in 2019. In 2019, MSM accounted for more than one-half of primary and secondary syphilis infections in males.

Maternal Health

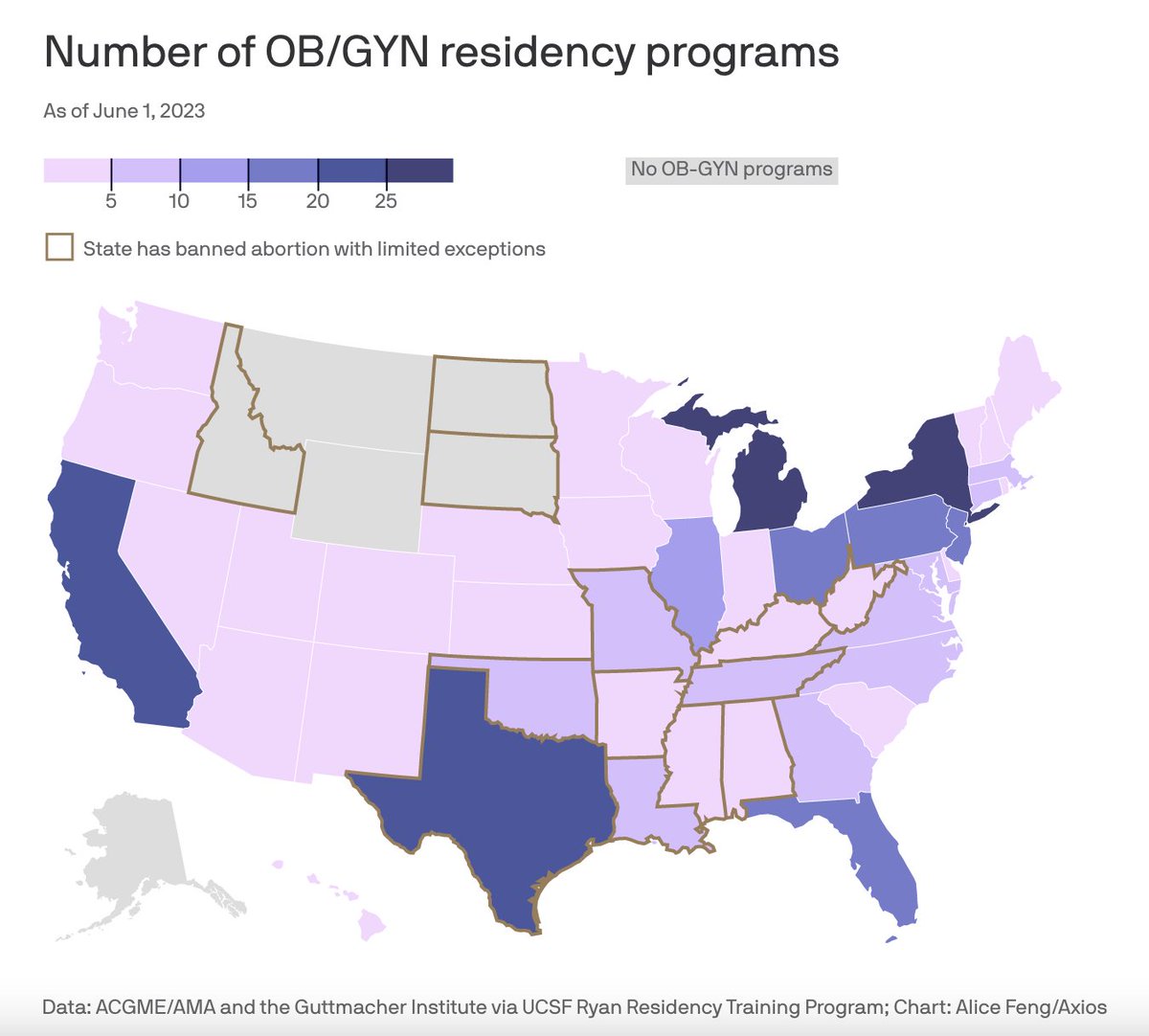

As the US is facing deteriorating maternal health outcomes (ranked 55th globally, despite ranking 2nd on healthcare spend), and an OB-GYN shortage, the need for a comprehensive maternity care solution is clear. Maternal health outcomes have worsened over the past few decades, especially for underserved and minority communities. Maternal mortality is on the rise, with outcomes worse in 2022 than in 1970, despite advances in healthcare and technology.

Maternal health deserts, geographic areas with less access to hospitals providing obstetric care, birth centers, OB/GYN, and certified nurse midwives are growing across the US, specifically in the Midwest and South as shown by the 2021 March of Dimes report (below). The need for robust maternal health solutions which increase access to care and leverage a multipronged approach with telehealth elements to provide care outside of metro areas is clear.

For the 6.3M pregnancies and 3.6M births annually with an average reimbursement of ~$14K per birth, its a ~$50B market expected to grow at a CAGR of 5% over the next five years. The demand for a multipronged approach to care services is driven by a growing emphasis on value-based care, the need to reduce healthcare costs, and the desire to improve patient outcomes.

- Largest Markets: California & Texas

- Mid-Sized Market: Florida & New York

Data Source: CDC

And in a post-Roe V. Wade era, where physician know-how, access to safe clinics, and overall patient experience are declining, how do we serve that 45% of pregnancies that weren't someone's intention?

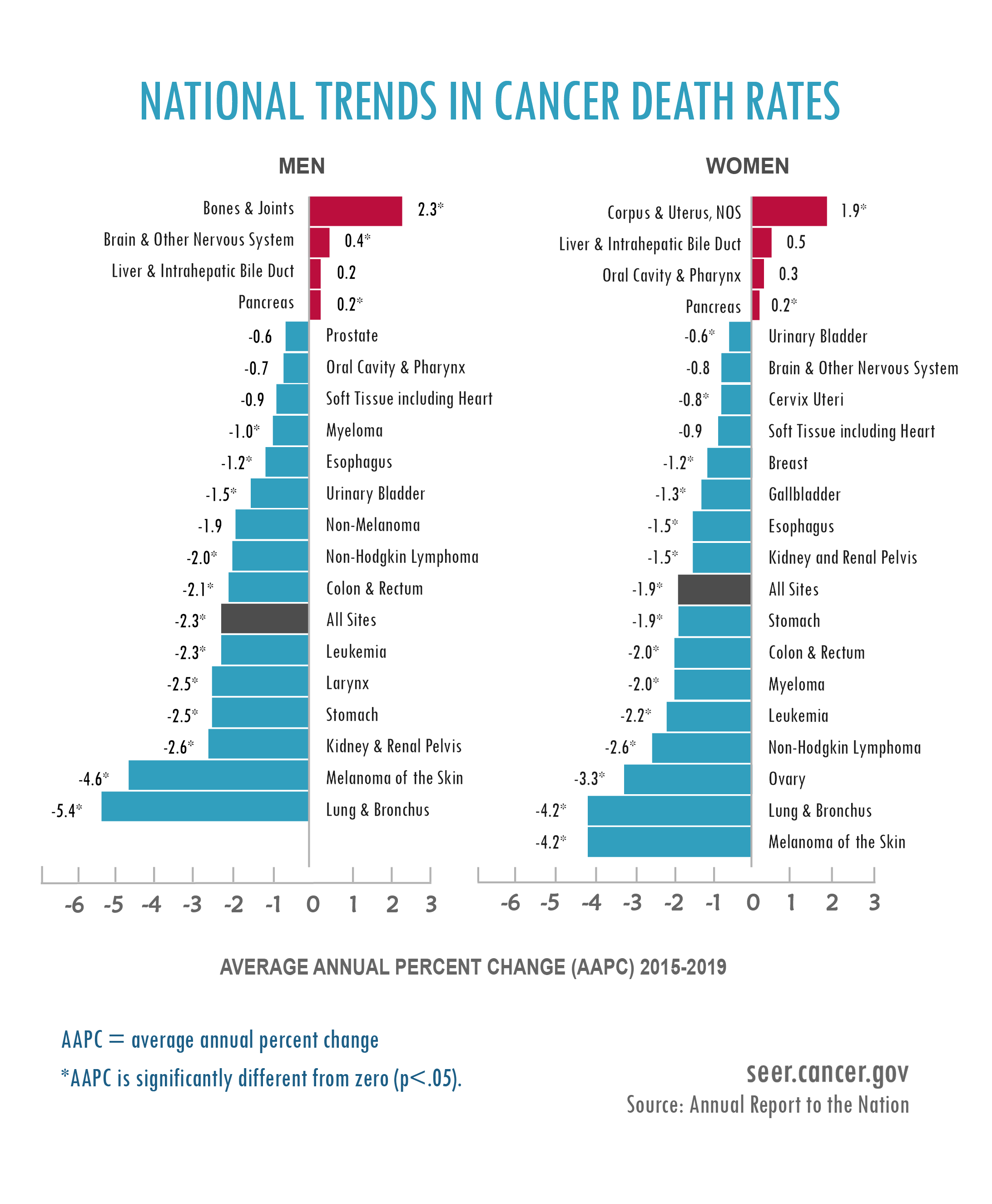

Cancer rates in women are increasing.

Breast cancer rates have increased by over 0.5% annually. Other cancers like thyroid, bladder and skin cancers are also up significantly in recent years, according to the CDC.

Incidence rates decreased for 7 cancers among women between 2014-2018: thyroid, ovary, colon and rectum, lung and bronchus, urinary bladder, brain and ONS, and non-Hodgkin lymphoma. However, incidence rates increased for 7 of the 18 most common cancers: melanoma, liver and intrahepatic bile duct, myeloma, kidney and renal pelvis, pancreas, breast, and oral cavity and pharynx.

Oncology drugs and treatments tailored for women could see high demand since few studies around gender-specific treatment exist. And with women only being mandated to be included in clinical trials for the last 30 years, and the NIH and other government-funded research not requiring a disaggregation of gender for outcomes, there's a lot we don't know.

Digital health and virtual care options can improve access.

Telehealth companies addressing women's health issues like menopause, birth control, postpartum depression, etc., through virtual consultations and treatment can help close gaps for underserved groups. About 20-25% of women report barriers in accessing healthcare.

As OB/GYN as a specialty is on the decline, and the US is filled with legal battles surrounding specific reproductive care like abortion and contraception, we need to find a way to leverage providers nationally.

Solutions which enable providers (clinical and non-clinical) to operate to their highest degree and take the burden of care off a specific speciality are the most attractive.

Policy incentives are aligned.

There are provisions in the Affordable Care Act around women's health access and coverage. Medicaid expansion has increased women's healthcare coverage. New policies could further boost funding and incentives around women's health initiatives.

While attacks on abortion are a set back, it creates more opportunity within contraception and prevention for the ~43% of unintended pregnancies.

And thanks to Papa Biden, there's now $200M dedicated to research after a requested $1B. It was a small step and government-supported, so my hopes aren't high that this will turn into much. But the credibility boost about the unmet need. Biden needs the women vote, I need general healthcare investors to start paying attending.

Valuations are attractive relative to potential.

Publicly traded women's health companies currently have price-to-sales ratios of 2-6x, indicating the market may be undervaluing the high-growth potential relative to the overall healthcare sector.

And hey, McKinsey says its not niche at a $1T market size to add to the global economy. But at 3.9B women, even that feels undervalued.

Segment poised for returns.

In summary, the stars are aligned for women's health companies to thrive over the coming decades.

Exits remain early, but early indicators of the upside potential are emerging. In a capital-constrained environment, founders are scrappy and do not need to raise massive dilutive rounds before becoming attractive acquisition targets.

In a capital-constrained environment, founders are scrappy and do not need to raise massive dilutive rounds before becoming attractive acquisition targets. Not only are investors likely to receive good returns, but founders are as well.

Some Recent M&A

Supportive demographics, policy, and social factors combined with unmet needs around chronic conditions, fertility, and access to care make this healthcare segment poised for $1B+ companies.

Attention from the White House, universities, research institutions, and private equity roll-ups all point towards profits. Any investor sleeping on this segment isn't maximizing their fiduciary responsibility to LPs.

After all, aren't we all here to make money?